You've probably heard the word “invest” thrown around more than a few times by now, but if you’re like most people, you may not necessarily be an expert on the subject. There's no denying the fact that investing can indeed appear to be a very intimidating subject at first glance.

For many people, the word “investing” summons the mental image of an endless sea of binary numbers that can only be understood by dark suits who have sold their souls to Wall Street. That’s basically the gist of it, right? Not at all. As a matter of fact, in the same amount of time the average child needs to learn how to ride a bike, you are perfectly capable of learning how to invest as an adult.

Before considering what particular types of investment style might be the most beneficial for you as an individual, it's more important to begin with the actual investment capital that you have to start with. No matter how appealing a certain type of investment may seem to be in concept, it doesn't mean anything if you can't afford it.

Even though most people think you have to be rich to start investing, the reality is you can get started even with a modest budget. Let's take a look at what you can invest in based on how much money you have.

What Can I Invest In WIth $20?

Now, to be completely honest, if you only have $20 that you can comfortably put towards any investment, then it may be in your best interest to invest time towards building up more capital. When it comes to single and double digit figures, then the main types of investments that you’ll realistically be able to consider will generally be online trading brokers and penny stocks. Certain online brokers will allow you to begin trading for as little as $7, though others may have high opening deposit requirements, so be aware of this.

Penny stocks are a controversial matter, and for good reason. In simple terms, a penny stock is a common stock that has a value of less than 1 dollar. Out of all of the different kinds of investments, penny stocks tend to be the most speculative of all.

There are many people made quite a profit from selling their ideas about how to pull in millions of dollars from highly speculative micro-investments, but there is no telling whether or not the bulk of their profit comes from penny stock investments or selling courses about penny stock investments.

Still, there just might be some among you have the right combination of reckless abandon, intuition and luck to pull off some truly magnificent things with rather small investments; however, the more pragmatic among us would heavily advise you to steer clear of these.

What Can I Invest In WIth $100?

At $100, your options expand ever so slightly. One of the more innovative methods for investing $100 is through regulated online lending. With certain peer to peer lending platforms like Prosper and Lending Club, you have the ability to loan out small amount of money out at interest rates that can give you modest returns on a monthly basis.

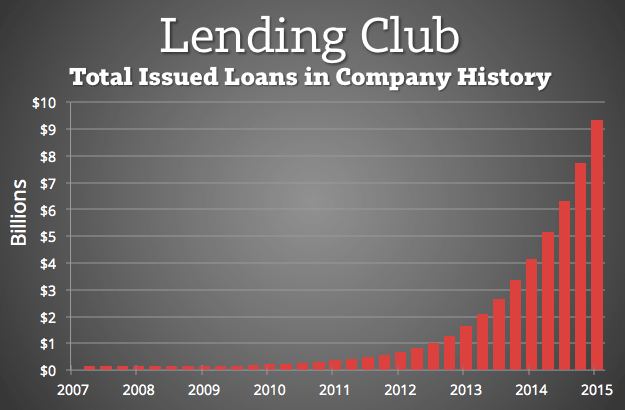

These companies make it possible for businesses to get money they probably couldn't get through traditional loans or investments. Here's a look at how many loans have been issued through Lending Club since it started.

$100 also gives you enough to begin putting forth a bit of money into learning about investing from the experts. It’s time to develop a strong relationship with your favorite local book retailer. At this point in time, you’re going to want to try and resist the temptation to put forth your savings into the first thing that looks good. Committing to a habit of reading one book a week or so about investing should be sufficient until your capital grows just a bit larger.

What Can I Invest In WIth $500?

Once you’ve managed to raise $500 of dispensable income, and you have a healthy emergency fund, you may begin to start considering what your first-time investments that may be into real company earnings. With $500, it may be a wise decision to make your first investment into a 401(k). At a 7% return, $500 will become $4000 in 30 years.

With a 401(k), you will be provided with a curated selection of investments that don’t have any minimum requirements associated with them; this could be a very ideal time to begin practicing the application of the knowledge of those books you’ve been reading as you saved up money. Making small-time “trial” investments will train you in the decision-making habits that create a shining portfolio.

What Can I Invest In WIth $1000?

With $1000, you will be in a very comfortable position to consider a Roth IRA. A Roth IRA will not take your entire $1000 to invest in, and that is exactly why it’s a wise decision to consider at this point.

Be careful not to confuse the Roth IRA with the traditional IRA. The earnings from a Roth IRA are usually tax-free, but there aren’t any tax breaks for the contributions. A traditional IRA, on the other hand, has its withdrawals taxed but also has tax-deductible contributions for both state and federal returns.

What Can I Invest In WIth $10K or More?

Once you have managed to save up enough dispensable capital to comfortably consider $10,000 for investing, then real estate could be a feasible option for you. Another feasible option would be to work towards paying down any outstanding debts that you have; the absence of debt is just as valuable, if not more valuable, than a yearlong winning streak for any investing campaign.

Some experts may suggest that you consider the different options for high-volume trading accounts as well, which could potentially give you returns from anywhere between 5 and 7% a month if you play your cards right.

Conclusion

You do not need to be a multimillionaire or a finance major in order to begin your journey into the investing world, but at the same time, it is in a beginner’s best interest to focus more on investing in their knowledge than in the market.

When it comes to the fear of investing, the first thing that gives people pause is the necessary uncertainty. The fear that people feel towards investing is similar to the uncertainty that some people may feel when it comes to gambling. The difference between gambling and investing is that investments don’t need to be a complete leap of faith into the wind.

As long as you stay disciplined in your budget management and remain constantly hungry for more knowledge about the nature of the market, you will always be in the best position to manage your risks and have the best possible returns.

Investing is a test of mental fortitude and emotional control, and in order to have the best of both of these qualities, your overall lifestyle needs to be conducive to good health. Prioritize living healthily, consume knowledge constantly, save your capital wisely, and then you will be ready to invest successfully at any level.