With retirement so far away and so many other expenses that need to come out of an entry-level paycheck, saving for retirement can seem like a luxury. But even with student loans, rent, and utilities that need to come out of our monthly earnings, starting a retirement fund early can pay off exponentially in the future.

Putting away money starting with your first paycheck can allow you to see that money compound for decades, so even if you’re just putting in small amounts, that little bit has time to grow before it's used. So while putting in small amounts now may seem unnecessary at the moment, you will be thankful you started early when retirement comes.

Starting a 401(k) doesn’t need to be a stressful process and once it's set up, you can easily begin putting money aside for retirement. Here are a few things anyone setting up a retirement plan should consider during the process:

1. Understand The 3 Magic Numbers of a 401(k)

The amount of money that you end up with once you reach retirement is dependent on a few different numbers. First, consider what you put into the fund. Second, you want to recognize how much money your employer is putting in. And finally, understand how much your account will grow each year.

The three magic numbers of a 401(k)

1. The amount you put into the fund

2. The amount your account will grow each year

3.The amount your employer will deposit

In many ways, the amount you put in will influence the other numbers. What your employer puts in each month is reflective of a portion of what you're putting in, and the more money that's in your account the more it can compound and grow.

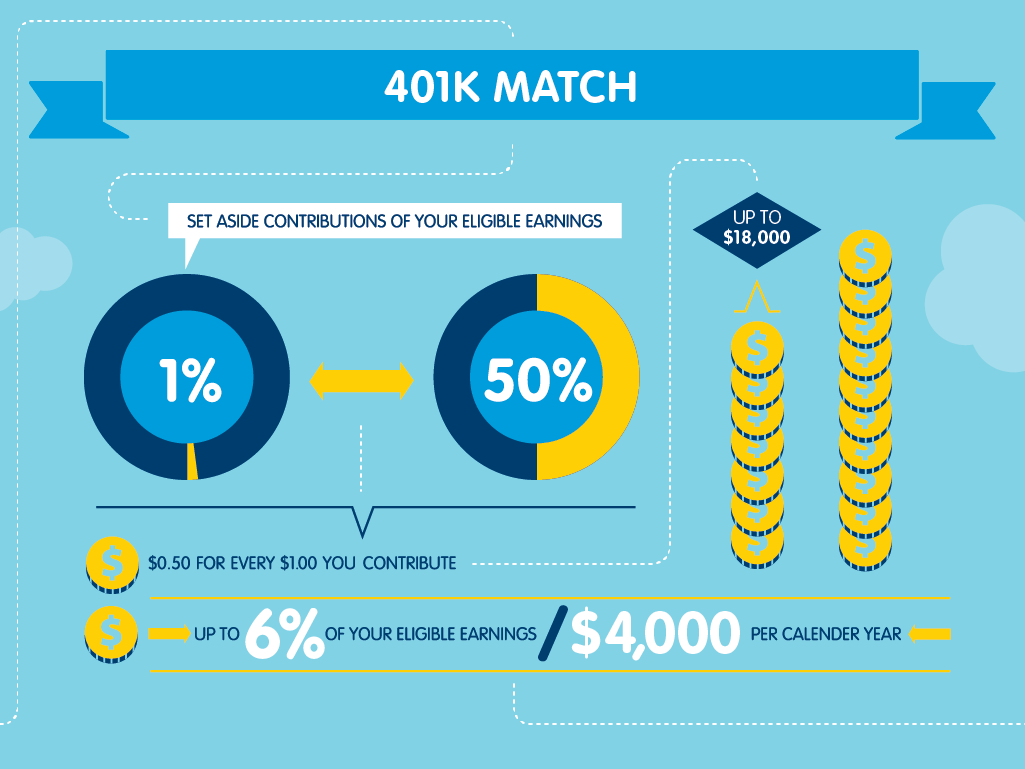

When trying to decide how much money to put into your 401(k) each month or year, consider how much your employer is willing to match. The money they contribute to your retirement plan is essentially “free money” and an easy way for your account to grow quickly. If you can afford it, put in at least enough to get the most out of your employee match rate.

2. Understand The Taxes

Unfortunately, your retirement fund isn’t going to be tax free. At some point, you will need to pay taxes on the money in your account and many plans have additional fees. While a 401(k) is important, you need to know what those fees and taxes are going to cost you. When you understand how they work, when they will be applied, and how much you will be expected to pay, you can get smart about your savings plan.

For a traditional 401(k) plan, you will not be expected to pay taxes on the money until you take the money out of your account.

But with a Roth 401(k) the money that's added comes from your salary after taxes. This means that when the time comes to make a withdraw, you will not be required to make any additional tax payments. If you're in a low tax bracket, a Roth 401(k) may be able to save you money in taxes in the long run.

You’ll also want a clear understanding of how much money in fees you will need to pay to keep your account running. While there may be no way to get around these expenses, knowing the fees upfront can help you avoid confusion and problems in the end.

3. Take Control

It isn’t uncommon for employers to automatically set you up with a plan for saving into your 401(k). While this pre-determined plan may work for some people, it might not be the best option for you. In most situations, that pre-determined plan includes what is called a target-date fund.

With a target-date fund, the money that you put in will be put into different investments by determined fund managers. These fund managers consider the amount of time until your expected retirement year and determine which investments to put your money into based on that date. As you get closer to the year you will retire, the investments become less and less risky.

This strategy works great for many people and there is a reason it's the go-to for many 401(k) plans, but even if you decide to go with a target-date fund, you want to understand how it works and where your money is going.

In the end, the money in your 401(k) is what you will need to live off of when you retire, so you want to ensure that you're in control of what that money is doing when it's in your account.

4. Stay Within Your Expenses

Although setting up a 401(k) is incredibly important for your distant future, you still need to think about expenses in your immediate future. It may be tempting to put thousands of dollars into your 401(k) each year, but if you’re struggling to make payments today it isn’t going to matter how much you have saved in the future.

Think of the payments you need to cover now.

If you have student loans, credit cards, mortgages, or car loans, all those payments should be under control before you start contributing to your 401(k).

You shouldn’t be struggling to make your loan payments because of your retirement contributions, no matter how great your employer match program is.

Consider your expenses every few months. If you feel yourself struggling to make ends meet, think about reducing the money you contribute to your retirement fund. If you find that you have some supplemental cash left over each month, it might be time to raise your contribution amount. A great thing about your 401(k) is that you’re always free to change the amount you're adding to it.

5. Don’t Let it Go

No matter what company you begin working with, chances are you’re not going to stay with the same company from your first job all the way through retirement. If you do, this isn’t a step you need to worry about, but for the vast majority of individuals, there will come a time that you’re leaving the company that originally established your 401(k).

When this time comes, you’ll have two main options options.

- Cash out your 401(k)

- Rollover your account to your new job

First, what you may be tempted to do is cash out the retirement fund you started with your original company to start a new one with your new employee. While this may seem like the easiest of your options, it's probably the worst one for you to go with.

Many 401(k)s have restrictions and guidelines in place to prevent you from taking money out of the account before it's time for retirement. This means that if you cash out your account before a certain age, you may be faced with penalties and fees. While it may seem like the best idea initially, it could cause you to lose a good chunk of the money you have saved.

Instead, your best option is to leave the money right where it's at. You have the option to rollover your 401(k) plan with you when you move offices and companies, and although it may seem like a hassle at the time, you’ll be thankful for the money that you save.

But when you’re thinking about looking for a new job, be sure you understand the company’s policy for their 401(k) matches.

While they may have helped you establish a great base of money in your retirement savings plan, there may be certain guidelines that mean you need to stay with the company in order to keep the money. If you move from the company too quickly, they are entitled to take their contributions out of your account. Consider what this time frame would be and if a move is worth essentially cutting your 401(k) plan in half.

While your 401(k) may not come into use for a few decades, it doesn’t mean you should put off planning for it. It can be difficult to get your finances in place, especially when you're dealing with and entry-level paycheck. But if you can afford to make retirement contributions now – no matter how small and insignificant they may seem at the moment – that money will have time to grow and compound. Even the smallest bit of money is better than no money at all.

Determine a percentage of each paycheck that you're willing to part with. Because 401(k) plans will take money straight out of your paycheck, it's a sum of money that you never even realized you had in the first place. Be sure that you can live within the means of your take home cash each month and allow your retirement savings to grow without any effort from you. But be sure to revisit your plan with each promotion or raise.

With the right planning, you'll be all set for retirement.