Paying for car insurance can be a drag, especially for a financed vehicle. You're paying for something you may never use, and you hope to never need it.

Most people (especially young adults) just get their initial car insurance quote, and never worry about it again. But the price you paid for car insurance when you first started driving isn't what you should still be paying today.

With a little research and negotiation, you can lower your car insurance payments!

How Much Does Car Insurance Cost?

Before we get into how to lower your car insurance, the first thing you should do is see how you stack up against the state and national averages.

In 2014, the average annual cost of car insurance across the country was $907.38 according to research from Quadrant Information Services.

To get a better picture of whether or not you're overpaying for car insurance, here's the average annual car insurance premiums by state.

| State | Monthly Insurance Rate |

|---|---|

| Alabama | $127 |

| Alaska | $134 |

| Arizona | $102 |

| Arkansas | $117 |

| California | $164 |

| Colorado | $130 |

| Connecticut | $137 |

| Delaware | $132 |

| Florida | $153 |

| Georgia | $183 |

| Hawaii | $117 |

| Idaho | $88 |

| Illinois | $114 |

| Indiana | $100 |

| Iowa | $88 |

| Kansas | $113 |

| Kentucky | $125 |

| Louisiana | $164 |

| Maine | $80 |

| Maryland | $151 |

| Massachusetts | $134 |

| Michigan | $213 |

| Minnesota | $113 |

| Mississippi | $115 |

| Missouri | $101 |

| Montana | $168 |

| Nebraska | $110 |

| Nevada | $116 |

| New Hampshire | $82 |

| New Jersey | $159 |

| New Mexico | $114 |

| New York | $98 |

| North Carolina | $88 |

| North Dakota | $143 |

| Ohio | $77 |

| Oklahoma | $131 |

| Oregon | $111 |

| Pennsylvania | $120 |

| Rhode Island | $168 |

| South Carolina | $110 |

| South Dakota | $130 |

| Tennessee | $116 |

| Texas | $135 |

| Utah | $99 |

| Vermont | $96 |

| Virginia | $93 |

| Washington | $125 |

| Washington DC | $177 |

| West Virginia | $210 |

| Wisconsin | $91 |

| Wyoming | $128 |

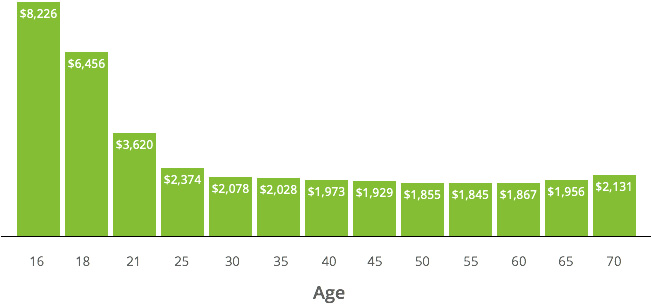

Unfortunately, being a younger driver also comes at a premium. The bright side is as you get into your later 20's, your rates should start decreasing. So if you're in your 20's and have been paying the same monthly insurance since you were 18, you can probably get your monthly premiums lower.

So what can you do to avoid paying higher than average car insurance rates? Here are 13 tips on how to lower your car insurance payments.

1. Be an Excellent Driver

Avoiding traffic violations and accidents is the best thing you can do for your auto insurance premium. You may not see the premium decrease right away, but some insurance companies will reward you for keeping your driving record clean. Not only will your premium drop, but also you may receive accident forgiveness. Only select providers offer accident forgiveness. Shop smart.

2. Remove all the Extras

Go over your policy details again and look for any features that you may have added without knowing it. Examples of those add-ons are roadside assistance, rental reimbursement and gap insurance. These features are quite helpful, but you can remove them if you are trying to stick to a strict budget. You can try removing them through your online account or calling the insurance company and asking the representative to remove them.

3. Change Your Deductible

Another little trick you can try temporarily is asking for a higher deductible. The deductible is that first lump sum of money that you have to put toward your auto accident before the insurance company will pay for it.

The deductive varies from about $250 to more than $2,500. You can acquire some significant savings by asking for the highest deductible. However, you should change it when you get back on your feet.

4. Shop Around

You still have time to shop around if you have not yet purchased insurance. You should receive a quote from at least three companies before you choose the provider from which you will purchase your insurance.

With more than 50 companies in the U.S., you have quite a selection. You May be able to find a small company or an agent in your area that can get you a rate that fits into your budget. Tell the agent what you have in your budget, and he or she can try to find you the perfect plan.

5. Avoid a Lapse in Coverage

Never allow your insurance coverage to lapse once you get it. A lapse can cause you several problems, including an increased insurance premium. On the other hand, your timely payments will cause the insurance company to appreciate you as a customer.

6. Sign up for Auto-Pay

Auto-pay is a nifty feature that allows the insurance company’s system to automatically pay you for your bill by placing a credit card on file with the company. Some insurance companies will offer you a discount if you sign up for that service. The discount may only be $5 to $10 a month, but it will help you save money.

7. Try to Raise Your Credit Score

There used to be a time when your credit score had nothing to do with your car insurance. Those times are gone. You now have to maintain good credit, or you risk having higher insurance premiums. The best ways to maintain good credit are to:

- Pay your debt on time each month.

- Use less than 30% of your available credit.

- Don not conduct too many inquiries.

8. Ask About Multi-Vehicle Discounts

Your insurance company may be willing to offer you a multi-vehicle discount if someone else in your household owns a vehicle. You may also want to inquire about group discounts if you are an upcoming business owner with employees. A multi-vehicle discount can provide you with savings of up to 25 percent off your insurance.

9. Don't Buy These Cars

If you still haven’t purchased your vehicle, then you will want to make sure that you do not buy a sports vehicle when you do. Sports cars have some of the most expensive premiums of them all, and with good reason.

A 2002 study by the University of Michigan revealed that sports cars have the highest risk for accidents. Imported luxury cars are at the opposite end of the spectrum, and economy cars are the happy medium. An economy vehicle will offer you a better premium than a sports car will, but it may not offer you as much pizzazz.

Here's a list of the 10 most accident prone vehicles.

- Ferrari 458 Italia

- Bentley Continental GT

- Ferrari California convertible

- Maserati Granturismo convertible

- Maserati Quattroporte

- Bentley Continental GTC convertible

- BMW X6 M

- Porsche Panamera Turbo

- Maserati Granturismo coupe

- Nissan GT-R

10. Buy a Car With Safety Features

Safety features can get you some huge discounts. Insurance companies will reduce your premium if you buy a car that has air bags, alarm systems, anti-lock brakes and the like.

You can save hundreds of dollars each month just because your car is safe. You should consider that very strongly when you start shopping for your vehicle.

11. Get Other Insurance From Your Provider

Just as you can receive a discount for having multiple cars on an auto policy, you can receive a discount for having multiple insurance policies with the same provider. Auto insurance companies usually offer several types of insurance. They may offer life insurance and disability insurance, for example. You can receive a discount from your provider by purchasing one of those bundles if you need it.

12. Sign up for a Defensive Driving Course

Defensive driving courses aren’t just good for helping you avoid accidents; they’re good for saving you money. Many insurance companies provide discounts to people who took their time to go through a defensive driving course. You can ask your prospective or existing insurance company about the possibility of giving you such a discount.

13. Park Your Car in the Garage

It may sound silly, but you can receive a discount for keeping your car in the garage as opposed to on the street somewhere. It reduces the possibility of a theft-related insurance claim. You may receive a healthy discount on your insurance for taking the precaution.

Now you know of 13 ways to lower your car insurance premium. You should be able to regain your financial composure once you choose the best options for your situation.