Let me know if this sounds familiar. You Google "how to budget" because you want to start putting some money away for your future. You start reading an article that tells you to put away 20% of your paycheck in your savings account. And you think to yourself, "20%?? I'm trying to figure out how I'm going to pay my cell phone bill next month!"

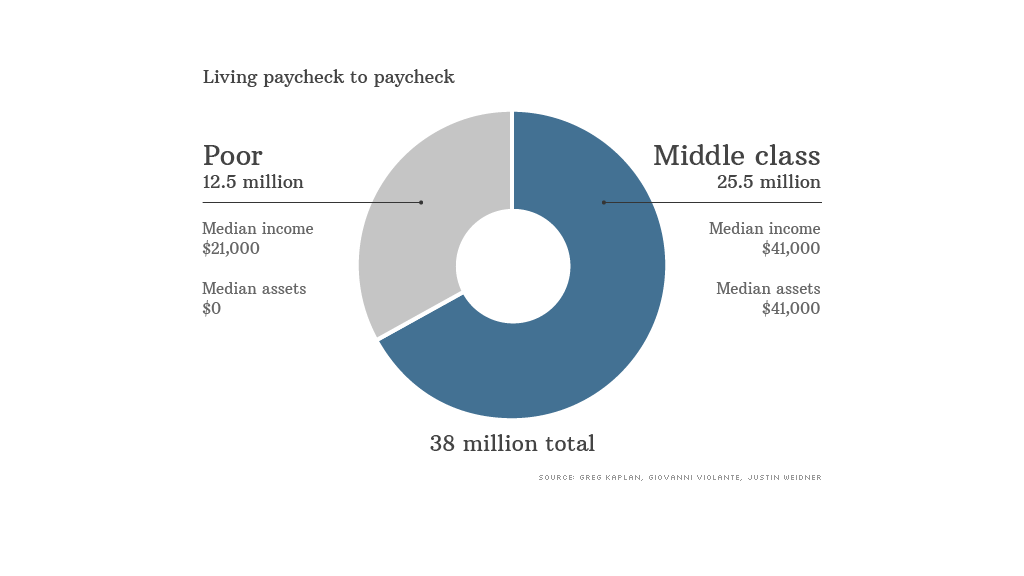

A lot of young adults are in that exact same position. You want to save money and budget, but you between student loan payments and rent, you're barely scraping by. Over 38 million Americans are living paycheck to paycheck, so putting money aside doesn't seem like much of a possibility. But there's hope.

Ask Yourself One Question

Life is a series of decisions. As much as it feels like you're hopeless in certain situations, the reality is you have choices. If you want something, you'll find a way to get it.

Think about people that say they want to lose weight, but then give a long list of excuses of why they can't do it. The most common of which is "I don't have enough time to workout." Ask any of those people to track every minute of their day for a week and I guarantee you they have at least 30 minutes a days each week to exercise.

The problem isn't that they don't have time, it's that they aren't willing to do what it takes. The same theory applies to your budget.

If you track your spending for a month, I can almost guarantee you that you'll find some places you can trim your expenses. The question is are you willing to do it?

Make More Money

I'm going to blunt here. If you're barely scraping by and living paycheck to paycheck, you only have two options if you want to get ahead. Either cut your expenses or make more money. We covered lowering your expenses already, but the second option is to make more money. Yea, I know. Easier said than done right? Actually not quite.

These days there are more ways to make money than ever.

- Get a second or third job: It's not what most people want to hear, but it's reality. If you really want to dig yourself out of a financial hole and start budgeting, work more hours.

- Start a side hustle: This method alone can get you out of debt and allow you to have money aside to start budgeting. Side Hustle Nation is filled with stories of people that not only made extra money through side hustles, but some built full businesses.

- Ask for a raise: Asking for a raise isn't even a thought for a lot of young adults. You're just happy enough to be employed. But if you're bringing enough value to the table, there's no shame in asking for a raise.

Ignore Popular Savings Formulas And Rules

The whole "save X%" of your income rule goes out the window when you're barely scraping by. It sounds weird in an article about how to budget, but the reality is those rules don't apply to you right now.

If you want to put something in your savings account, put $5 or $10 in. It's not a lot, but it'll at least get you in the habit of saving once you're in a better financial situation.

The reality is that unless your'e on your feet financially, your savings can wait a bit. Because more than likely you'd end up withdrawing the little bit of money left in your savings when you get in an emergency situation anyways. Your goal right now is to work yourself out of a hole.

Try to Negotiate Better Credit Card Rates

Did you know that some banks will actually let you negotiate your interest rate?

I know it seems like most credit card companies are out to "get you" and milk you for every last penny, but they're also businesses. They want to get paid their money, so sometimes they will work with you to come up with a better solution than having you pay $10 a month on a $4,000 balance.

A survey from Bankrate found that 56% of customers that called their credit card companies asking for a lower interest rate were successful.

Assuming your credit isn't horrible, try calling your credit card company and letting them know your position. You want to pay off the debt, but the interest rate is making it unmanageable. You might be surprised how helpful they can be sometimes.

Worst case scenario is they say no, and you're right back in the same boat that you're in right now. But if you don't ask, you'll never know.

Here's a chart to give you an idea of how much more money you end up paying on your debt if you only make the minimum payments.

Current Debt | Percentage of Balance Paid | Amount of Balance Paid | Amount of Interest Paid | Years to Get Out of Debt |

|---|---|---|---|---|

$1,000 | 3% | $30 | $684 | 8 |

4% | $40 | $465 | 6 | |

6% | $60 | $285 | 4 |

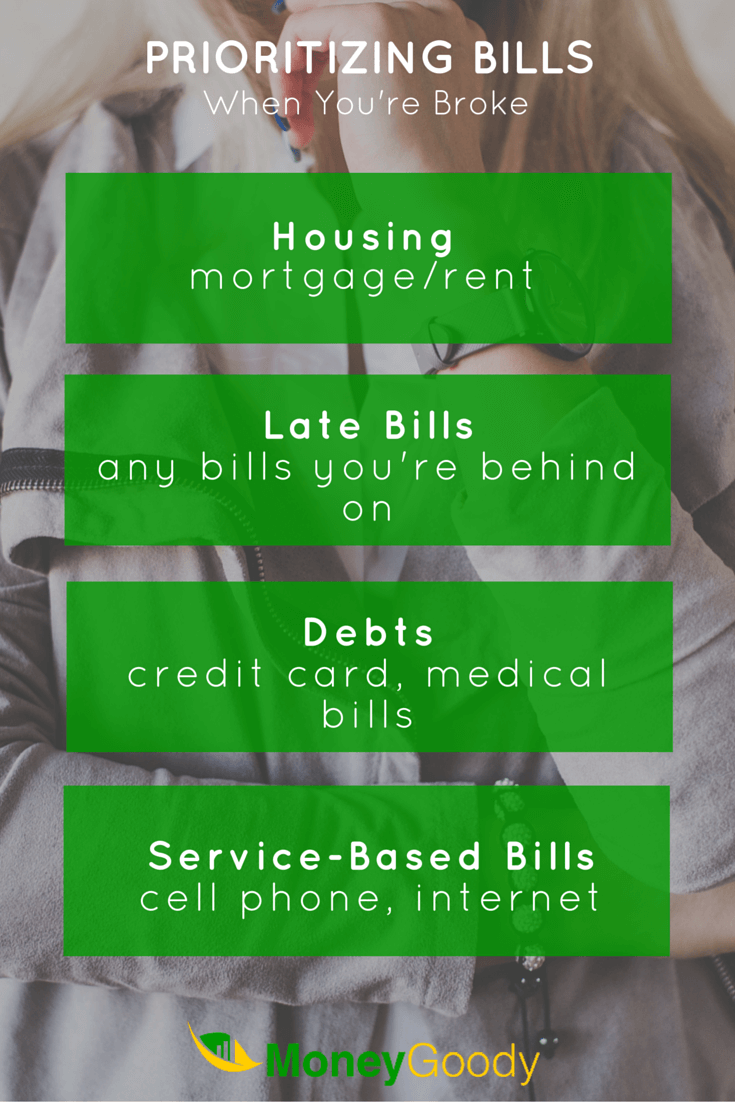

Prioritize Your Bills

One of the biggest mistakes people make when they're trying to get caught up on their bills is treating every bill equally. It'll take you a lot longer to get in a position to start budgeting if you keep this approach.

You shouldn't ignore your bills, but at a certain point you need to make some a priority over others. For instance, your rent or mortgage should always come first. The last thing you want to do is lose your home.

If you're behind on any bills, make those your next priority. You need to get caught up so you can start to get some breathing room.

Next, look at bills that are debt. Whether it's medical bills, student loans or credit cards. With these, you may be able to call the company and work out something like we mentioned earlier. Whether it's an extension or temporary deferment plan until you're caught up with other bills.

Lastly, don't forget about your service based bills. Things like your cell phone, internet or power. These bills are usually a lot less forgiving, and failing to pay them can get your services cut off.

The good thing about these bills is they can be somewhat flexible if you're at least making an effort. Even if you're not paying the full balance, partial payments might be enough to keep the lights on.

Just make sure you call and explain your situation first. Don't just start paying half of your cell phone bill each month and expect to keep your service.

Make A Reasonable Budget

After following the steps above for around 3-6 months, you should be in a much better financial position. Well at least not living paycheck to paycheck each month. This is when you need to sit down start planning out a real budget that you can stick to.

Some key things to keep in mind.

- Emergency fund: Instead of depositing most of your leftover money into an investment or savings account, start creating an emergency fund. If you want to avoid getting back into the same position you were in before, you need to have money put aside for emergencies. Generally this should be enough to cover your living expenses for at least 3 months. It'll take you some time to save it up.

- Minimal entertainment budget: After digging your way out of a rough financial spot, the thought of going to the movies or out to dinner is terrifying. You're most cautious of every penny you spend now. But that doesn't mean your entertainment budget needs to become $0. Allocate a very small portion of your budget for entertainment, and look for cheap or free ways to have fun.

- Stretch your dollar: Now that you have a little extra money, you might be tempted to spend a little more on little things here and there. But until you're completely in the clear, keep the frugal mentality you had when you were at your lowest point. It'll allow you to extend your runway a bit and keep your expenses at a reasonable level.

- Don't forget your debts: As you start to have more money freed up, you'll be able to put more money towards paying off your debt. You may have been paying less during your "broke period," but it doesn't have to stay that way. Make very small increases in the amount you're paying towards your debt each month.

Reassess Your Budget

After your budget is in place for a few months, it's time to go through and look at your expenses again. You can compare them to what they were six months ago and look for any other opportunities to save some extra money.

Your budget should always be evolving as your income, expenses and overall lifestyle does. Constantly assess where you are and adjust your budget as necessary.

Figuring out how to budget when you're broke isn't a quick and easy process. First you need to focus on getting your finances on track, then start crafting a budget that you'll be able to manage comfortably.

Don't fall for the lie that you can't budget if you're broke or don't make a lot of money. With some hard work and sacrifice, you'll be back on your feet in no time.