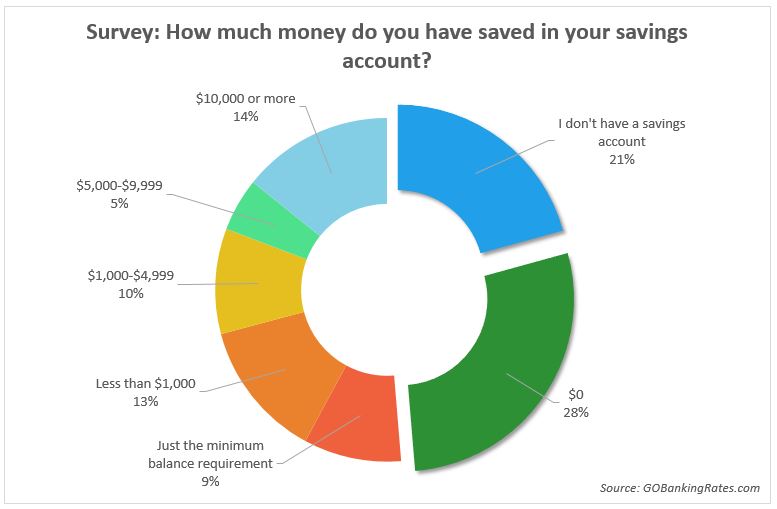

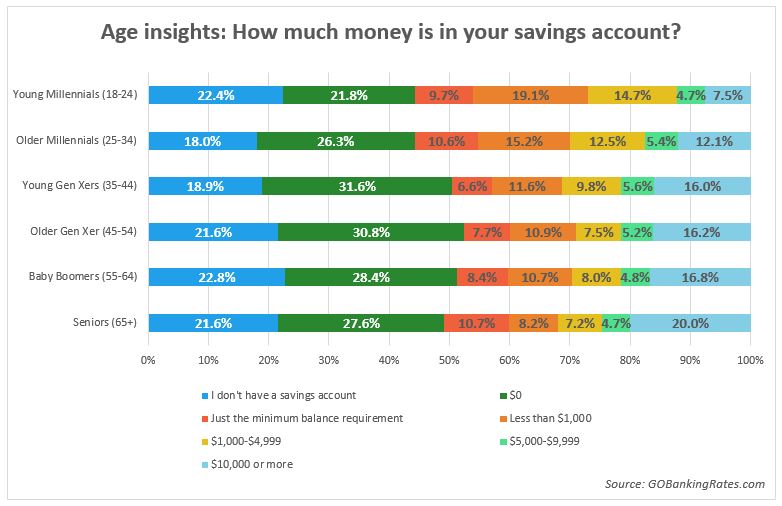

Struggling to get your personal finances in order? You’re not alone. A GoBankingRates survey found that 62% of Americans have less than $1,000 in their savings account.

Millennials are the main ones struggling to save. The survey found that 73% of 18-24 year olds and 70% of 25-34 year olds have less than $1,000 in their savings account.

Some of you probably aren’t shocked by these numbers. After all, with student loans and credit card debit, the idea of having money set aside is almost laughable for a lot of millennials.

The reality is that most millennials struggle with money because they were never taught how to manage it. Unless you were fortunate enough to have your parents teach you about the importance of managing your money or were able to take some type of personal finance related course in school, there’s a very good chance you’re a part of that 70 plus percent of millennials that aren’t saving.

But don’t worry, we’ve got you covered. Money management isn’t as difficult or complicated as some people make it seem. You don’t have to go out and become a “guru” in all aspects of personal finance. Taking small steps can lead to big results. Just learning personal finance basics will help put you in a position of not living paycheck to paycheck anymore.

We’ve put together a huge resource of 81 personal finance tips every young adult should live by. You don’t have to put them all into practice at once, but getting into the habit of incorporating them into your life will get you on the right path towards being financially free.

On to the list!

Credit & Debt

Only Take On Smart Debt

One of the biggest mistakes young adults make by far is taking on unnecessary debt. For instance, you sign up for a store card because the cashier says you’ll save 10% off your purchase.

It sounds like a good idea at first since you’re getting a discount. But what tends to happen is you go back to the store and start buying more stuff because you’re using credit. That debt is going to keep piling on until you’re at the point where you have to make monthly payments for a long time to pay it off. The 10% you initially saved by getting the card gets washed away by the interest on the card.

Instead, focus on smart debt. These are things like a mortgage or even student loans. You get a long term benefit from the debts, so it’s worth it in the long-run. If you have a plan for what you want to do after college, student loans aren’t as horrible as you think.

Only Keep One Credit Card

Piggybacking off the previous tip, don’t fall for the trap of signing up for every credit card offer you receive. While you’re in college (and especially after you graduate) you’ll start to receive a lot of credit card offers in the mail.

Why? Because it’s the time in your life when:

- You’re probably struggling financially and can’t afford to pay for things straight up.

- You’re young enough to be able to pay them back over a period of time. There aren’t too many 90-year-olds receiving credit card offers.

- You haven’t had a chance to develop a bad credit history yet.

- You’re more more impulsive, so you’ll rack up a lot of debt.

As intriguing as zero percent interest for three months sounds, don’t do it. Get one credit card and use it responsibly. It’ll save you from the nightmare of having to consolidate multiple credit cards and being overwhelmed with credit card debt.

Pay Off High Interest Debt First

If you have multiple creditors (student loans, credit cards, personal loans, etc.) which should you pay off first? The one with the highest interest rate? The one with the largest balance? The one with the lowest balance?

There are different schools of thought on this, but a lot of the time it’s a good idea to pay off high interest debts first. It’s the approach financial expert Suze Orman recommends in her book, The 9 Steps to Financial Freedom.

Paying off high interest debt first saves you the most money in the long run. The sooner you’re able to pay it off, the less interest you’ll end up paying.

Check Your Credit Report

When is the last time you checked your credit report? Never make the mistake of just assuming you have good credit because you make your payments on time or you don’t have a bunch of debt.

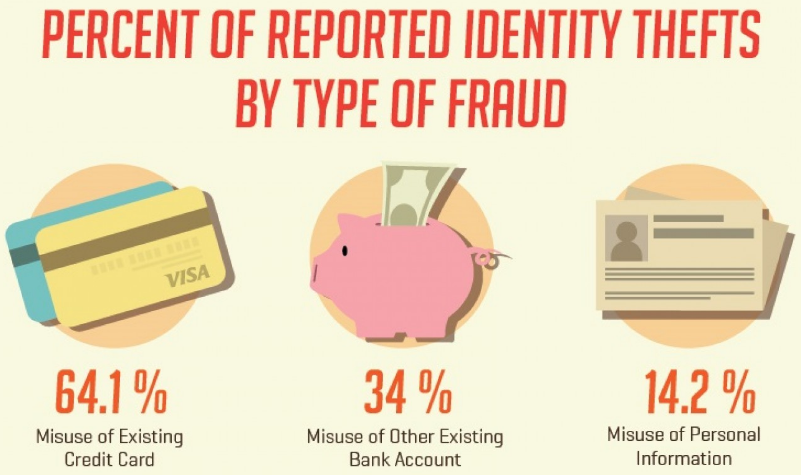

Identify theft is a huge problem and there’s always a possibility that someone used your information to take out a loan, open a credit card or create other debts.

A common misconception is that checking your credit hurts your credit score. You can check your credit score as often as you’d like, but it’s usually not necessary. Attorney Margaret Reiter recommends checking your credit report annually, which should be your minimum. Every six months or so should be good.

Avoid Co-Signing

Your friend or family member asked you co-sign for a new car or a loan because they have bad credit. They assure you they will make all the payments on time and maybe even try to guilt you into doing it. Don’t cave in.

The reason most people need a co-signer is because they have a record of not paying debts, missing payments or paying late. Co-signing for them is like betting on a losing football team. Is there a possibility that they can win? Sure. But historically, they’ve proven to be unreliable, so it’s probably a good idea not to bet on them.

What’s even more troubling is that most college students aren’t even aware of what they’re getting themselves into when they co-sign for someone. A U.S Bank survey found that 47% of undergraduates thought a co-signer wouldn’t be liable for paying back a student loan if the student isn’t able to find a job.

When you co-sign, you are financially obligating yourself to be responsible for the debt if the other person doesn’t pay. In most cases, you’re asking for trouble when you say yes.

Learn About Repayment Options for Student Loans

The reason you’re looking for personal finance tips is probably largely due to student loans. Here’s the process students tend to go through. Apply for loans to pay for college, wait until they graduate and then struggle to pay the amount the lender tells them to pay.

It doesn’t have to work that way. If you can’t afford your student loan payments, check with your lender. Most of them have options to help make your payments more affordable.

Whether it’s switching to income-based repayment, consolidating multiple loans, or another alternative, there are options. Contact your lender and see what they can do to help you.

Only Use 30% or Less of Your Total Available Credit

We’ll spare you the technical explanation of credit utilization rates (the amount of your available credit you actually use), but just remember this – spending a large percentage of your total available credit can impact your credit score.

General best practice is to use no more than 30% of your available credit. So if your credit card limit is $1,000 don’t use more than $300 of it. If you get close to the 30% mark, make a payment to bring it down.

If you find yourself struggling to stay under 30%, consider increasing your credit card limit. Just make sure you’re not spending more than you’re able to pay off.

Keep Your Credit Score High

Remember the people I mentioned earlier that ask you to co-sign for them? It’s because they have really bad credit and a lender isn’t willing to work with them unless someone with good credit agrees to be on the hook for them.

However, there are also people with just mediocre or close to bad credit as well. They can get a loan, but they end up having to pay a higher interest rate because they’re what’s called a “high risk borrower.”

Have you ever seen a commercial for a car dealership promising super low interest rates? The advertised rate isn’t for everyone. If you walk in with your credit score of 500, don’t expect to qualify for the same interest rates as the person with a 700 score.

Keeping your credit score high will allow you to get better rates on cars, credit cards, personal loans and even a mortgage when the time comes. Good credit can save you a lot of money, so keep your score high.

Choose A Credit Card with a Rewards Program

If you’re going to use a credit card, you might as well get some added benefits. A lot of credit cards offer cash back or points that can be used to buy airline tickets, gift cards and other goodies.

A good starter card is an Amazon Rewards card. Just make sure the card you’re getting has a good interest rate in addition to the rewards program.

Don’t Keep Deferring Your Student Loans

This is one of the best money management tips for students (or graduates) I can give. Trying to defer your student loans for as long as humanly possible can do more harm than good. As much as you may want the government to forgive student loans, it’s probably not going to happen.

Depending on the type of loan you have, you may be accruing interest during the deferral period. Also, you’re just delaying the inevitable. The sooner you start making payments on student loans, the quicker you’ll pay them off and be done with them.

Like I mentioned earlier, a better option if you’re struggling to make student loan payments is to contact your lender and check what other repayment options you have. That way you’re at least paying something.

Explore Debt Consolidation

I touched on this a bit earlier, but another option to consider if you have multiple loans is to consolidate them. There are a few different benefits.

- You only have to make a single payment each month.

- You may pay less interest because the higher interest loans will be averaged in with the others.

- Your monthly payments will probably be lower.

Here’s some good information on consolidating federal student loans. For other debts, you can contact a bank, credit union or other financial institutions to see what options they have.

Budget & Spending

Set a Budget

When you start looking for personal finance advice or help, one of the first things most people will tell you is to start a budget. Budgets are important because they prevent overspending (assuming you stick to the budget).

Budgeting is a lot of like dieting. Just like there are a bunch of different types of diets, there are different approaches to budgeting. You just have to figure out the strategy that works for you. The best kind of budget is the one you can stick to.

Here’s a list of five different approaches to budgeting that you can consider.

- The envelope system

- The 50/30/20 Rule

- Snowball budget

- Digital budgeting

- Reverse budgeting

Also, Power Over Life has an amazing guide on how to pay off debt that that goes in on more tactics to get out of debt.

If you don’t feel like doing it solo, you can talk to a personal finance advisor that will look at your income, expenses and lifestyle, and create a budget for you.

Track Your Spending

Along with your budget, you’ll want to get into the habit of tracking your spending habits. You’ll probably be shocked by how much you spend ordering out or going to Starbucks five days a week.

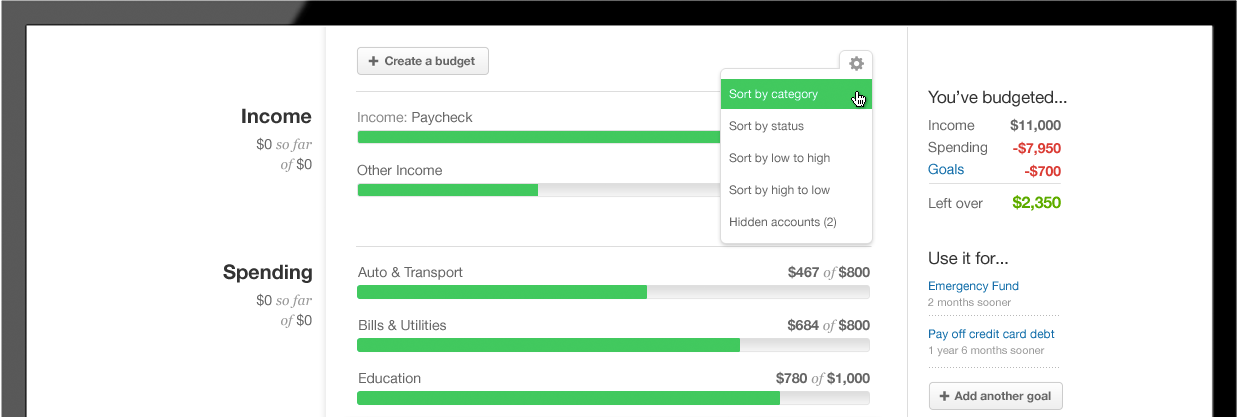

Mint.com is probably the best tool available for the average Joe. Mint connects to all of your different accounts (checking account, savings, credit cards, etc.), categorizes your purchases and displays all the info in simple charts and graphs.

If you haven’t heard of Mint, download the app ASAP. It’s a game changer!

Try the All-Cash Diet

Do you know what the easiest way to stay in credit card debt is? Keep using the credit card.

The all-cash diet is really more of an approach to spending money than a budget tactic. Instead of using your debit or credit card for day to day purchases (excluding things like bills), you only use cash.

The theory is that if you’re limiting your spending to just what you have in your wallet, you won’t overspend. It’s great for people that don’t have the greatest self control when it comes to spending. Or people who have the habit of making impulse purchases.

You take out a certain amount of money based on your budget, and that’s all you get to spend. The all-cash diet can be extremely effective and even helped one guy pay off over $100,000 in debt.

Research Products Online Before Going to the Store

The internet is a beautiful thing. Aside from being filled with awesome cat videos, it also revolutionized the way we shop. Instead of waiting until you’re inside the store facing a salesperson that will try to get you to spend more than you planned, you can find exactly what you want online.

Here’s why this is a personal finance tip and not just a tip for shopping. When you look online first, you can find the lowest price available.

On top of that, stores like Best Buy, Walmart, Target and others also offer in-store pickup. That means you don’t have to be the person that walks into the store looking for a Blu-Ray movie and walk out with a 4K TV, PS4 and a soundbar. You just go and pick up exactly what you need, and go back home. Simple.

Spend Based on Your Income

We all know people that spend way above their means. Blame it on credit cards, expensive tastes or whatever you want, but spending more than you can afford is a huge problem that leads to debt.

Spending based on your income doesn’t just mean buying less stuff. It also pertains to the type of products you buy. For instance, you may want to buy all organic food at the grocery store, but if you can’t afford it, you’ll have to look for alternatives.

Maybe it means buying some organic products and some regular ones. Or maybe you have to get a lower end car for now because you can’t afford the Lexus you really want. Learn to spend within your means and you’ll avoid a lot of money problems.

Don’t Loan Money You Can’t Afford to Lose

If you watch enough episodes of Judge Judy, you’ll learn about the stress that comes along with lending people money.

Here’s a great rule of thumb for loaning people money. If you can’t afford to lose it, don’t lend it.

For instance, if someone asks you to borrow $100 but you’ll absolutely need that money in two weeks to pay your cable bill, don’t lend it.

As pessimistic as it sounds, always approach loans with the expectation that you won’t get paid back. Not only will it save you from stressing when the person hasn’t paid you back, but it can also avoid the awkward situation of having to frequently ask someone to pay you back because you desperately need the money.

Cut Down on Your Bills

Make a list of all of the bills you pay on a monthly basis. Cable, internet, utilities, software subscriptions, gym membership, etc. Now go through the list and see if there’s anything you can live without. You’ll probably find one or two expenses you can afford to live without.

Try living without them for a while and see how it goes. Or look for cheaper alternatives to them to save money without having to give up the benefits.

Buy the Right Insurance

Getting insurance is one of the first “adult” things a lot of twenty-somethings do. Whether it’s health insurance, car insurance or even life insurance, it’s a good idea to protect yourself.

Unfortunately, most of us make the mistake of not shopping around for insurance. You might just use whatever your parents use or whatever’s offered at your job. However, taking some time to do research could potentially save you hundreds or even thousands each year.

Here are some quick tips to save money on insurance:

- Don’t pay for more coverage than you need.

- If your car isn’t worth much, just get liability coverage (unless full coverage is legally required where you live).

- Try to get as many discounts as possible. Some insurance companies offer discounts for students, having multiple policies, using paperless billing, etc. Find out what discounts you’re eligible for with your insurance company.

- Don’t feel obligated to use your job’s health insurance. The premiums (the amount you pay monthly) are generally based on the overall company’s health. If there are a lot of high-risk employees (i.e. older people, or people who frequently get sick) then your premiums might be higher. If you’re a healthy young adult, you might be able to get a better deal alone. Just shop around.

Shop for Value

Contrary to popular belief, saving money doesn’t automatically mean buying lower end products. For instance, when you go to buy a laptop, buying the $150 model might seem like a good way to save some money. However, think about the long-term value of the product.

Lower end laptops usually don’t last as long, so you’ll probably need to replace it sooner than you would a higher end laptop that’s built to last longer. Don’t judge purchases just from the price. Instead, think about the value you’ll get from them over time; it’ll save you money.

Cancel Unnecessary Subscriptions

Still have that gym membership you signed up for last January that you never use, but you’ve put off canceling it because you have to go into the gym instead of doing it online? You’re basically throwing money down the toilet.

With nearly every service you can think of offering a monthly subscription, most people are subscribed to more things than they need. Do a cleanse of the different services you’re paying a monthly subscription for but aren’t using or don’t need.

Don’t Go Shopping with Big Spenders

Trying to keep up with the Joneses will leave you broke. If you have friends that have expensive tastes, going out with them can be a little intimidating. You feel like you have to spend as much as them so you don’t seem broke, or you don’t want to ruin the vibe.

Instead, try suggesting some more affordable things to do to have fun that are in your budget. Either that, or find some cheaper friends!

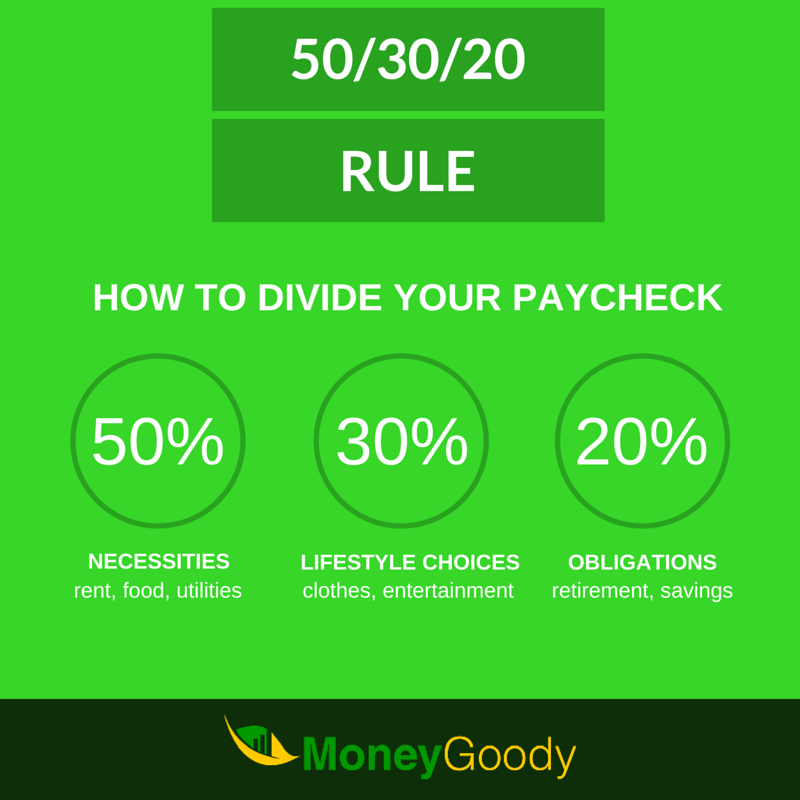

Adopt the 50/30/20 Rule

The 50/30/20 rule is a popular approach to budgeting. With the 50/30/20 rule, you divide your income into three separate buckets.

50% of your income goes to essentials and necessities:

- Food

- Rent/mortgage

- Utilities

- Gas or transportation

30% of your income goes to lifestyle choices:

- Monthly subscriptions

- Ordering out

- Entertainment

- Vacations

20% of your income goes to your financial obligations:

- Emergency fund

- Retirement

- Savings

- Additional payments on debts

Don’t Be Afraid to Negotiate Prices

You might be surprised by how much you can save through negotiating prices. Most of us are in the habit of hearing or seeing how much something costs and paying that amount. However, the price you see isn’t always the price you have to pay.

For instance, you may be able to negotiate your cable/internet bill, interest rates, or car insurance. Some companies are very dedicated to keeping customers happy and are willing to be flexible with their pricing to keep you on board.

You can also try buying your fruits and vegetables at a farmer’s market if there’s one nearby. Negotiating is pretty common there, especially towards the end of the day when they’re trying to get rid of their remaining produce.

Use Coupons

There’s no shame in using coupons. I’m not saying you have to become an extreme couponer like this.

But taking a few minutes to look through your grocery store’s circulars and find manufacturer coupons online before going shopping can be extremely helpful. Here are some sites that post deals and coupons.

Become a Smart Grocery Shopper

In addition to using coupons, take your time to explore your options when you go to the grocery store. See what’s on sale and look for products that give you the best price per serving.

For instance, one brand of toilet paper may be $8.99 while the other is $10.99. But you need to check how many sheets you get with each one to decide which gives you the best bang for your buck. Remember the tip from earlier: shop for value!

Cut Your Phone Bill

According to Michael Gikas, senior editor for electronics and technology at Consumer Reports, 50-70% of American overpay for their mobile phone plans. Two of the most common reasons you’re overpaying are:

- You aren’t using all the data you’re paying for

- You’re not taking advantage of lower priced plans that come out after you sign up

The first one is a simple fix. Check your phone bill to see how much data you actually use. If you’re nowhere near your max, downgrade.

The second is a bit trickier. No cell phone company is going to call or email you to let you know you can save money by switching to their new lower cost plans. It’s up to you to stay up to date on the latest deals your carrier is offering. Then just call and ask to switch.

Since most carriers no longer force you to sign up for a long term contract, swapping plans is pretty simple and straightforward.

Make Cost-Saving Substitutions

This is probably one of the more difficult personal finance tips to follow. It’s hard to tell a Starbucks addict to start drinking $1 coffee from McDonald’s or 7-11. Luckily, you don’t have to make super dramatic changes to start seeing savings.

Think of the little things you buy that have cheaper alternatives like band aids, pain relievers or water. These are all simple products that can be swapped out for generic or store brands without sacrificing quality. When you swap out a variety of them, it adds up.

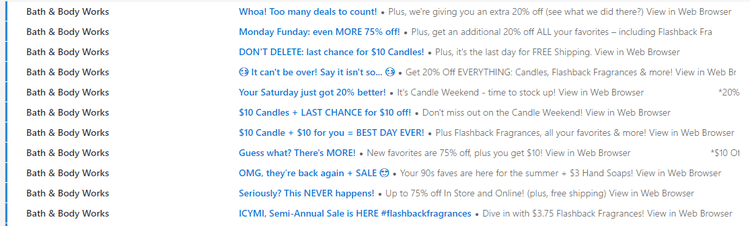

Unsubscribe from Newsletters/Deal Emails

This one is for all my impulse buyers out there that can’t resist a good deal. If you’re subscribed to a store’s newsletter, your inbox is probably packed with promotional emails filled with discounts and deals for things you don’t really need.

One of the biggest culprits is Bath & Body Works. They run sales seemingly every day and send you plenty of emails to make sure you’re aware of them.

Start hitting the unsubscribe link. Don’t worry, the money you save by not buying things you don’t need just because they’re “on sale” will more than make up for the 5% you’d save from the email.

Lifestyle

Move Out When You’re Ready

I get it, you’re a strong independent young adult that doesn’t need to live under the confines of your parents’ house. But before you rush out to get your first place, make sure you can actually afford it.

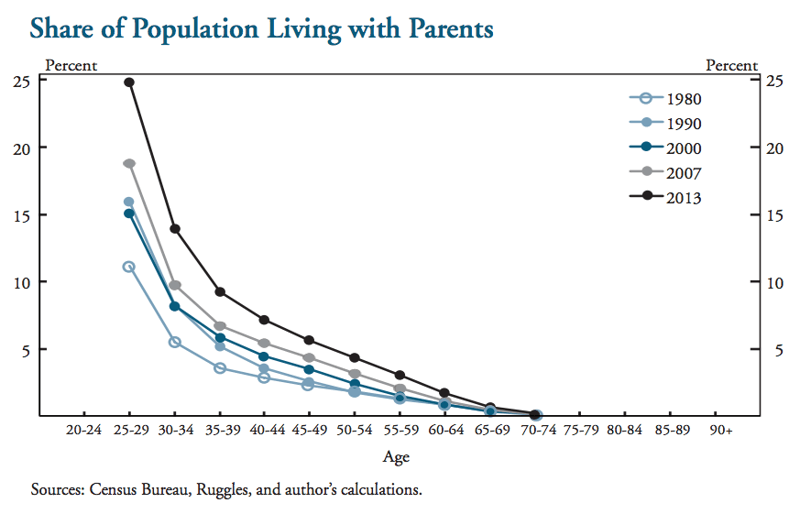

The number of adults living with their parents has risen over the past few decades, and it’s not just millennials.

People usually look at the “embarrassment” of having to move back home as the main downside. However, the financial hit you take while trying to live alone and failing can be pretty dramatic.

Whether it’s racking up credit card debt to survive or getting evicted because you couldn’t afford your rent, moving out before you’re ready is a big financial risk. Assuming your parents are on board, take some time to financially prepare yourself for all the new expenses you’re going to have when you move out.

Find Cheap/Free Ways to Have Fun

Going out every weekend can get expensive really quickly. Instead of spending money on a bunch of expensive alcohol every Friday and Saturday night, try having a night in, go to places with low-cost specials or think of other alternatives to spending a lot of money to have fun.

Split Entertainment Costs

Shout out to the one person paying for Netflix, Hulu, Amazon Video and HBO GO while five other people leech off your account!

But seriously, you can save a lot of money by dividing up the costs of monthly subscriptions like streaming services. Some services like gyms even offer lower pricing if you sign up with a friend or family member. Divide and conquer!

Plan Your Meals Ahead of Time

Have you ever gotten home after a long day of work and been too tired to cook, so you order out? It happens to the best of us.

If you’re doing this three or four times a week, it really starts to add up. Avoid the added expense of ordering out by planning your meals ahead of time.

The same thing applies to lunch. Instead of buying lunch every day, prepare your meals at home to save some money. It’s also healthier.

Get Your Significant Other Involved

Teamwork makes the dream work. Getting your significant other involved in saving money and focusing on your personal finances can make the process more enjoyable and a lot easier.

This could mean coming up with creative date-night ideas or just keeping each other accountable for your spending.

Wait to Have Children

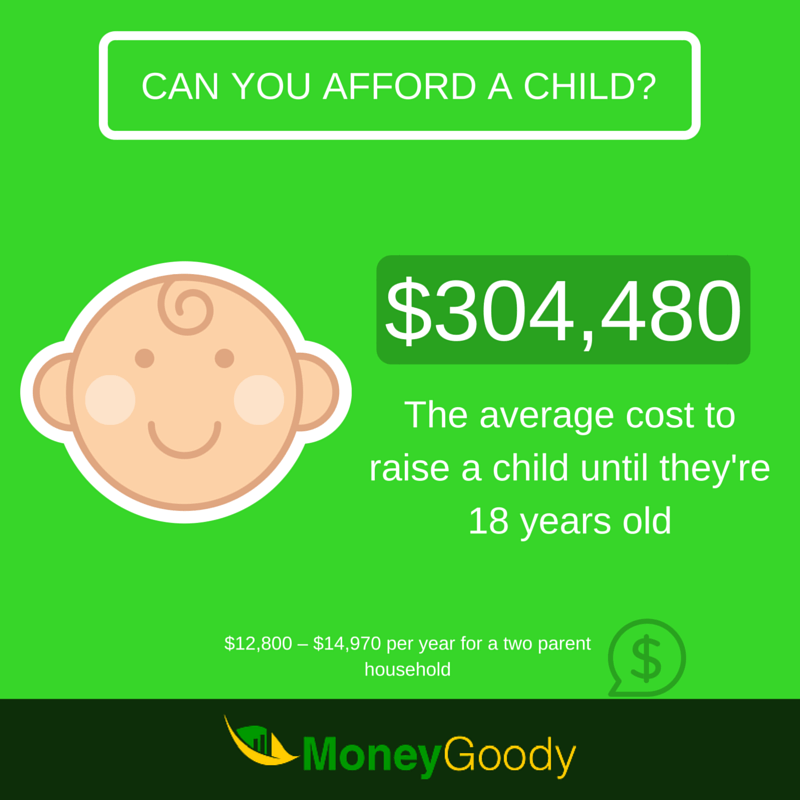

Do you have an extra $304,480 sitting around? If not, maybe hold off on having a baby. That’s the average amount it takes to raise a child through the age of 18 in the U.S., which amounts to about $12,800 – $14,970 per year for a two parent household. And as we saw earlier, children are living at home for much longer than ever before, so you’ll probably be paying for some additional years too.

Having and raising a baby is already stressful enough as it is; no need to add onto the pressure by stretching your finances beyond their limit.

Go to the Doctor

Some of you are probably thinking, “How does spending money at the doctor save you money?”

A lot of medical issues are progressive, meaning the longer they go undiagnosed and untreated, the worse they become. Obviously as the condition worsens, it becomes more expensive to treat.

Going to the doctor regularly allows them to catch issues early on, before they have a chance to fully develop or worsen.

Adopt a Healthy Lifestyle

Continuing from the previous point, staying healthy is a very underestimated way to save money. The cost of being unhealthy is staggering. Heart disease and stroke cost Americans nearly $1 billion a day in medical costs and lost productivity.

The worst part is, they’re preventable through eating better and being more active. You don’t have to make gigantic changes right away, but small steps like getting up to walk throughout the day or choosing vegetables instead of french fries as a side can get you started.

Not only will you save money on health costs, but you’ll also live longer and feel better. It’s a win-win.

Go DIY When Possible

The DIY craze really exploded over the past 5-10 years. Between Pinterest, blogging, YouTube and HGTV, DIY projects have become the thing to do, which is great.

There’s a tutorial online for almost anything you can think of, whether it’s how to change your oil or even replacing your garage door. The DIY movement has allowed the average joe to save tons of money on services they previously would’ve had to pay someone to complete for them.

Here’s a word of caution. Bigger projects might require a professional. If you try to fix a pipe in your wall and screw it up, you could end up paying even more money to a plumber to come and fix the original problem plus the damage you caused. Only make DIY projects of things you feel very confident in completing.

Get Rid of Items You Don’t Use/Need Anymore

Remember when Spring Cleaning was a thing? It seems like once eBay started to become more commercial, people stopped looking for old things in their house that they don’t need. But I urge you to reconsider.

Getting rid of old items you don’t use or need anymore can be an easy way to make some extra money and free up some space. You can sell you stuff on eBay, Amazon, or even at local yard sales. You can also just donate it.

Spend some time going through your house and collecting the stuff you can get rid of. Try not to get too sentimental. Ask yourself whether or not you really need it. If you haven’t used it in six months, it’s probably not a necessity.

Control Your Vices

Whether you’re a smoker or you like to head t the casino every now and then, we all have vices. Unfortunately, those vices can become pretty expensive.

You should probably try to cut out unhealthy vices like smoking altogether, but if you like to occasionally partake in activities that are less harmful to your body but still pricey, try to limit them as much as possible.

Live in a Cheaper Area

Depending on the city and state you live in, this could be a huge money saver. For instance, Chicago is packed with dozens of neighborhoods with varying rent prices. You could save hundreds each month by living in one of the neighborhoods with a lower cost of living.

Some people associate higher prices to safety, so they avoid living in neighborhoods where the rent is a bit less. However, some neighborhoods are less expensive for other reasons, such as not having as much public transportation.

In some cases, you can luck out and move into an up and coming neighborhood. Generally, these are neighborhoods that weren’t as nice at one point but over time, they cleaned up. It takes the housing prices a while to start to rise, so if you get in early you can rent or even buy a home for a great price.

Walk Score is a great resource to check how safe a neighborhood is. And here’s a list of the 10 cheapest cities to live in.

Pay Your Bills Before Making Lifestyle Purchases

If you’re following the 50/30/20 plan, this shouldn’t be too difficult. Make sure you’re covering your necessities BEFORE spending any money on lifestyle purchases or non-necessities.

That new PS4 or 50-inch TV you’ve been eyeing shouldn’t come before your rent or food. After you’ve paid off all your other expenses and put some of your money away for savings, you can use some of what you have leftover for those lifestyle purchases.

Stop Trying to Keep Up With the Joneses

Are you the type of person that has to have the latest iPhone the day it releases, no matter how much it costs? Or you’re constantly buying new clothes to keep up with the latest fashion trends?

If you can comfortably afford to buy the latest and greatest products, that’s fine. But if you’re buying it all with credit cards because you can’t really afford it, it’s a problem.

Practice patience and spend within your means. That iPhone will still be available in six months, and fashion is a matter of taste. No need to splurge in order to “look rich.”

Get a Roommate

Want to know how to cut your household expenses in half? Get a roommate. If you feel comfortable living with someone else, getting a roommate can be an amazing way to save a lot of money.

In addition to splitting your rent in half, you’ll also be able to save money on your utilities or even food in some cases. Just make sure the person you’re moving in with is responsible and tolerable.

Don’t Be Embarrassed to Take a Staycation

When everyone at work is bragging about their amazing trip to the Bahamas over the summer, the thought of spending your vacation at home can be a bummer. However, staycations don’t have to mean laying in bed for a week.

You can use the time to explore your city a bit and visit some local landmarks and attractions. Sometimes when you live in a place for a long time, you take for granted all of the cool opportunities tourists from out of town see.

There’s no shame in having a staycation; just make it a fun experience. That doesn’t mean you should never go out on a trip for your vacations, but if money is tight, it might be a smarter decision to stay local this year.

Don’t Go Back to School Just Because You Don’t Know What Else to Do

You’ve been out of college for four years, you’re working at a job you don’t like that has nothing to do with your field, and you just feel stuck. So what do you do? Go back to school, of course!

That’s the scenario a lot of young adults find themselves in after school. The result is additional student loans that you’ll be paying back for a large chunk of your lifetime.

I’m not saying you shouldn’t go back to school. If furthering your education will get you where you want to go in life, then go for it. But if your only reason for going to graduate school is because you feel “lost” and don’t know what to do with your life, you might want to rethink it.

Instead of spending those extra years in school trying it figure it out, talk to a career coach or counselor. Or just spend some time trying to figure out what you want to do in life. It’s a lot cheaper than paying tens or hundreds of thousands of dollars to get another degree that you probably won’t ever use.

Don’t “Worry About It Later”

Credit cards are built on the idea of “worrying about it later.” How often have you seen something in a store that you wanted but couldn’t really afford, and ended up buying it anyways? You probably said to yourself, “I’ll worry about it later.”

Don’t worry about it later, make your purchases in the present. Even better, plan out your purchases ahead of time so you’re 100% certain you can afford it without relying on credit.

Listen to People Who Have Been There and Done That

As young adults, we can be a bit hard-headed sometimes. We don’t want to take advice from people older than us because we think we have it all figured out. But a lot of the time, we know about half as much as we think.

Instead of trying to figure out personal finance on your own, seek out advice from people who have made mistakes and can teach you how to avoid them. It could be your parents, relatives, coworkers or even a mentor.

If none of those are an option, there are a ton of books and articles online written by personal finance experts that you can rely on. The information is out there, but it’s up to you to consume it and learn from it.

Don’t Fall for The Social Media Lifestyle Hoax

If you want to feel horrible about where you are in your life, browse Instagram for a while. The pictures of “millionaires” with luxury cars working outside on the beach are enough to make you completely question where you went wrong.

But here’s the thing. As Essena O’Neill pointed out when she “got off of social media,” a lot of what you see on Instagram isn’t real!

https://www.instagram.com/p/9qFRlquWhY/

People will rent cars, clothes, jewelry and even houses to make their lives look more extravagant than they really are. And a lot of the non-celebrities with large followings you see flaunting tons of products are generally getting paid to post them, or they were given the products for free.

Trying to live up to what you see people doing on social media is a good way to go broke.

Weigh the Costs of Buying vs. Renting a Home

The idea that you have to wait until you’re older to buy a home is nonsense. The theory behind that is you should be settled down and have more stability before buying a house. It’s true that you shouldn’t buy a house if you’re financially unstable, but not buying a house because you’re 25 is ridiculous.

So many young adults automatically resort to renting instead of buying. However, depending on your situation (where you live, how much you earn, etc.) it could actually be cheaper for you to buy a home than rent!

One of the biggest reasons young adults are encouraged to rent instead of buy is because they think they need a large down payment to buy a house. However, there are plenty of ways to buy a house with little to no money down.

You can use this calculator to give you an idea of whether buying or renting is the best choice. Then talk to a real estate agent to find out more information.

Practice Preventive Care for All Aspects of Your Life

In most cases, it’s cheaper to maintain something than to wait for it to break and then repair it. That includes everything from your car to your health.

For your car, that means getting your oil changed, checking your fluids, being aware of strange noises under the hood and not driving like a crazy person. Taking those steps can prolong the life of your car and keep you from having to pay high repair bills that nobody likes.

Maintaining your body involves eating right, exercising and going to the doctor and dentist for regular checkups.

The same concept applies to your pets, electronics and anything else that might break down over time.

Don’t Be Afraid to Borrow From Friends

I’m just going to go ahead and put a big disclaimer here: I’m not talking about borrowing money. Getting money involved in your friendships can get really messy. I’m talking about borrowing products.

For example, if a new video game just came out and you want to play it, check to see if one of your friends has it and is willing to let you borrow it.

Or maybe you have a flight coming up and you want a tablet to use while you’re on the plane. If you can’t afford to buy one without using a credit card, why not ask a friend to borrow theirs?

When you’re borrowing things from friends, keep it to a minimum. Just like borrowing money, you can start to come off as a freeloader. If you’re borrowing your friend’s laptop every other day, it’s probably a good idea to just buy your own.

Also be respectful of the fact that some people don’t like to lend out their stuff. So if they say no, or you can sense they’re hesitant, don’t push them.

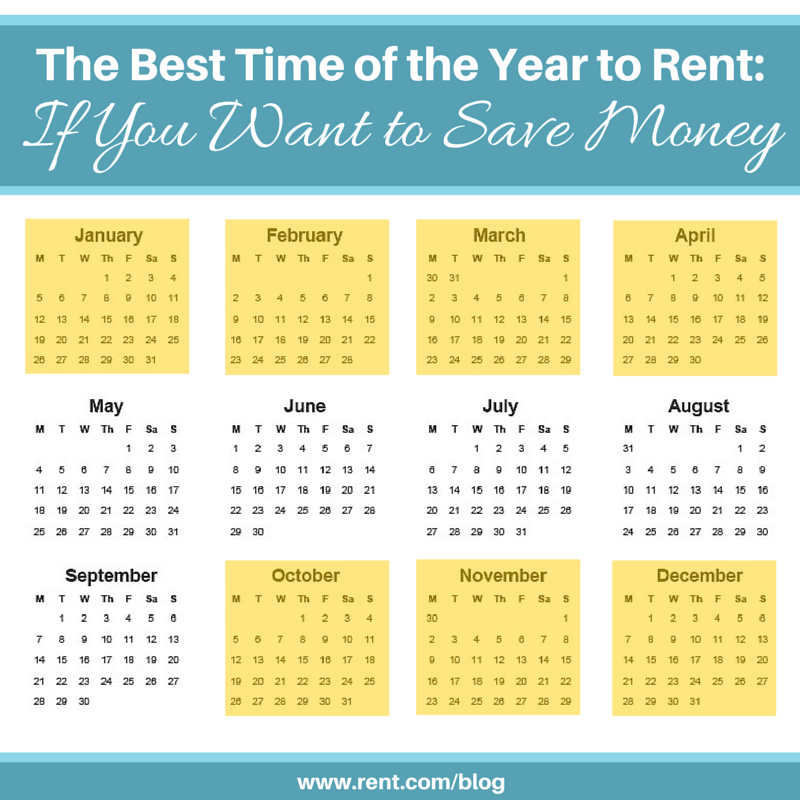

Look for Apartments During the Fall/Winter

If you’re looking to rent an apartment, timing is important. It’s cheaper to rent during certain times of the year than others.

According to Rent.com, the best time to rent if you want to save money is between October-April.

The reason behind this is fewer people tend to move during the colder months. As a result, landlords sometimes lower their rent pricing in order to fill any vacant units they have available.

Look at Menus Before You Go Out to Eat

This is a great personal finance tip for people that like to go out to eat. Instead of waiting until you get to the restaurant to decide what to order, plan your meal ahead of time. Check out their menu online before you go.

When you wait until you’re in the restaurant to decide on what you want, you’ll probably be hungrier from the aroma of the delicious food and the time you spend waiting for your waiter/waitress. As a result, you’ll end up ordering more food than you probably should.

Also, looking at the menu ahead of time will allow you to scope out the lower cost items, which will save you some extra money as well.

Create Stability in Your Life

This doubles as a personal finance tip and a general tip for life. When I say stability, I’m not talking about getting married and having kids. I’m talking about being a responsible adult.

That means not doing things like getting arrested, repeatedly losing jobs, and other things that can set your entire life behind.

You’re not a child anymore, so don’t act like one.

Investing

Start Investing Early, and Often

Investing isn’t something you should wait to do. Luckily there has been a huge movement towards investing for young adults, largely because of the internet.

Since most schools don’t teach students about investing, your best resource will be what you can find online. The earlier you start investing, the more you’ll be able to earn long term.

Talk to a Financial Advisor

It’s never too early to talk to a financial advisor. It can seem intimidating as a young adult when you barely have any assets and aren’t earning a lot of money, but don’t worry. This is actually the best time to set up an appointment.

Financial advisors will help you start off on the right foot by determining what your goals are. Then they can steer you in the right direction for how to get there.

Unfortunately, a lot of people only speak to a financial advisor when they:

- Have a lot of money

- Just went through a financial crisis

Don’t wait for either of these extreme cases, just do it now.

Build Wealth, Not Just a Savings Account

You’ve probably noticed a running theme with these first two personal finance tips about investing. As young adults, particularly millennials, the concept of “saving” has been drilled into your head. However, if you want to truly take your finances to another level, you have to go beyond saving, and look at ways to build wealth.

Your money earns little to nothing by just sitting in a savings account. Savings accounts are seen as safe because you won’t “lose” the money like you could if you invested it. However, the rewards for investing are well worth it, particularly when you start to learn the ins and outs of it.

Get rid of the “savings account” mindset, and look for ways to build wealth through investing.

Try Acorns

Speaking of investing, Acorns is a very popular app to get started with stocks. The way it works is by connecting to your bank account. For every purchase you make with your debit card, Acorns rounds the total up to the nearest dollar (you can change these settings a bit) and invests that spare change into over 7,000 different stocks and bonds.

For instance, if you were to buy a piece of candy for $1.60, Acorns would round up to $2.00 and invest the additional $0.40 for you. Here’s a video that explains how the investments work.

It’s a great way for young adults to get started with investing and stocks because it’s low risk and simple. You don’t have to do anything extra outside of using your debit card to make purchases like you normally would.

Learn About Compounding Interest

In layman’s terms, compound interest is when the interest you’re earning also accrues interest itself. Instead of trying to break it down here, Investopedia has a great resource on compounding interest that’s a great read.

Tony Robbins also has a great book that talks about compound interest as well. Check it out.

Banking

Review Your Bank Account Transactions Weekly & Monthly

When’s the last time you took a look at your bank statement? Ever since the movement to paperless banking, fewer people look at individual transactions. Instead, they just look at how much money is in their account. Break that habit.

Every week and at the end of the month, take a look at your transactions. This has a couple of benefits. For one, you’ll be able to spot any suspicious transactions. Like I mentioned earlier, identity theft and fraud are rampant today, so you need to protect yourself.

Second, it gives you an idea of where your money is going. Again, use Mint to categorize your purchases and make it easier to track your spending.

Keep Your Savings Account Separate from Your Checking

Are you the type of person that tends to keep a really low checking account balance? If so, it’s probably best to keep your savings account separate from your checking. Why?

What tends to happen is you overspend in your checking account, then start to dip into your savings. Since mobile banking is so common, you can easily transfer over money from your savings to your checking account in seconds.

The problem is your savings account should go untouched. And most people don’t tend to re-deposit the money they withdrew from their savings account. It just starts to shrink and shrink until there’s almost nothing left. Set a budget, put that money in your checking and don’t overspend.

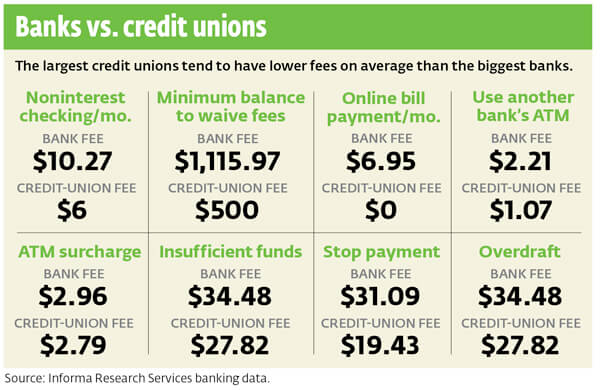

Use a Credit Union Instead of A Bank

There are a lot of good banks out there, but if you’re able to find a great credit union in your area, it might be a better option.

Many credit unions tend to have far less fees and better interest rates for all types of loans. With banks, you’re a customer, whereas with credit unions, you’re a member. The difference is the bank aims to make as much money off you as possible because their main goal is to increase profit.

Credit unions aren’t for profit. Because of this, they’re able to pass profits to their members through better interest rates and even dividends!

Avoid Bank Fees

Nobody likes getting fees. Of course, as I mentioned, joining a credit union can save you from a lot of fees. But there’s always a chance that you’ll be hit with some type of fee at some point.

Banks charge fees for everything from opening a certain type of account to not having the minimum account balance or even not using your account enough. I’m serious, some banks and credit unions charge inactivity fees.

Avoiding these fees will differ with each type. For instance, you should always avoid any type of checking or savings account that has a monthly fee just for existing.

You may also be able to save on a billing statement fee (a fee for receiving a paper statement each month) by switching to paperless statements.

For any type of account activity fee such as an overdraft or foreign transaction fee, you may be able to get them waived by calling the bank.

Set Up the Right Bank Account

As I hinted at earlier, not all bank accounts are equal. Before you join any bank or credit union, make sure you understand the different types of accounts available.

For instance, some banks and credit unions offer different levels of checking accounts. The higher level accounts may require a minimum monthly balance, but in return you’ll get some extra benefits unavailable in the lower level accounts. If you’re confident you’ll be able to keep the minimum balance, it may be worth considering.

Just weigh out all your options and don’t rush to make a decision.

Saving

Plan for Retirement

The reality for young adults today is you’re probably not going to get social security, so you’d better start preparing for retirement as soon as possible.

Many of the options available to older generations just aren’t viable today. For instance, most millennials won’t stay at one company long enough to have a pension, and a lot of startups that are fueling job growth in major cities aren’t offering benefits like a 401K match.

That means you’re in control of saving for your retirement. The good news is there are so many options available, including opening an IRA (preferably a Roth IRA) and making wise investments early on.

Ask Your Job to Put a Portion of Your Paycheck Into Your Savings Account

You know you should put money aside into your savings account, but you either forget or just flat-out don’t want to. A good workaround for this is to automatically deposit part of your paycheck into your savings account.

If your company has direct deposit, ask HR if they can deposit a percentage of each paycheck into your savings account. It’s as simple as filling out a form and specifying how much you want to deposit each pay period.

Have an Emergency Fund

You never know what could happen. A blown tire, unexpected medical costs or other expenses can pop up at any moment.

Instead of relying on credit cards to fund emergencies, have an emergency bucket set aside that you can use just in case. Think of it like insurance. Put a little bit of money into it each month, and it’s there if you ever need it.

There is no set amount you should keep in the emergency fund, but aim for at least a few hundred dollars.

Keep F**K You Money, Just in Case

F**k you money is similar to an emergency fund, except it’s specifically for people with a job. This is money you have set aside to keep you afloat in case you ever lose your job.

The theory behind it is you should always be financially stable enough to support yourself for a certain amount of time in case you either lose your job or quit. It’ll allow you to tell your company f**k you if you happen to work somewhere you hate.

And of course, nothing with the economy is for certain. Whenever you work for another company, there’s a possibility of being let go. You should have enough saved up (aside from your savings account) to survive for at least three months without additional income.

Start a Roth IRA

Roth IRA accounts have become extremely popular over the years, particularly among young adults. Here’s a great definition of what the Roth IRA account is:

A Roth IRA is a special retirement account where you pay taxes on money going into your account and then all future withdrawals are tax free.

The main benefit here is you don’t have to pay taxes on the money once you withdraw it, as long as you do it after you are 59 ½ and have met the 5 year holding period. Here’s more information on Roth IRAs and how they work.

Be Realistic

Reading articles and guides like this one tend to get you really motivated to make financial changes, and that’s great. However, at the same time you have to be realistic.

The reality is some people may not be able to invest 20% of their income into savings. Since a lot of twenty-somethings are struggling to pay off student loans and other debt, the suggested numbers you read about might not work for you.

The important thing to remember is that you should save something. Even if it’s just $20 a paycheck, it’s a start. Don’t stretch yourself too thin trying to follow advice that doesn’t apply to you.

Career

Diversify Your Income Streams

One thing millennials have been great at is breaking the chain of working a 9-5 for over 50 years and hoping you have enough to retire.

Side hustles and entrepreneurship have become the norm and people are no longer relying on a single source of income. In fact, you could argue that having multiple income streams is becoming a necessity. It’s also easier than ever with tools like Fiverr, Upwork, Uber and other companies that allow you to make money from anywhere.

Here’s a list of ideas to make some extra money on the side that you can start right now.

Negotiate Your Salary

If you’re struggling to save money each month, you have two options:

- Lower your expenses

- Increase your income

A lot of people automatically resort to the first option because it’s less intimidating. However, if you truly deserve more money, then attempting to negotiate your salary is worth the try. It’s much better than trying to decrease your quality of life by cutting out the things you enjoy.

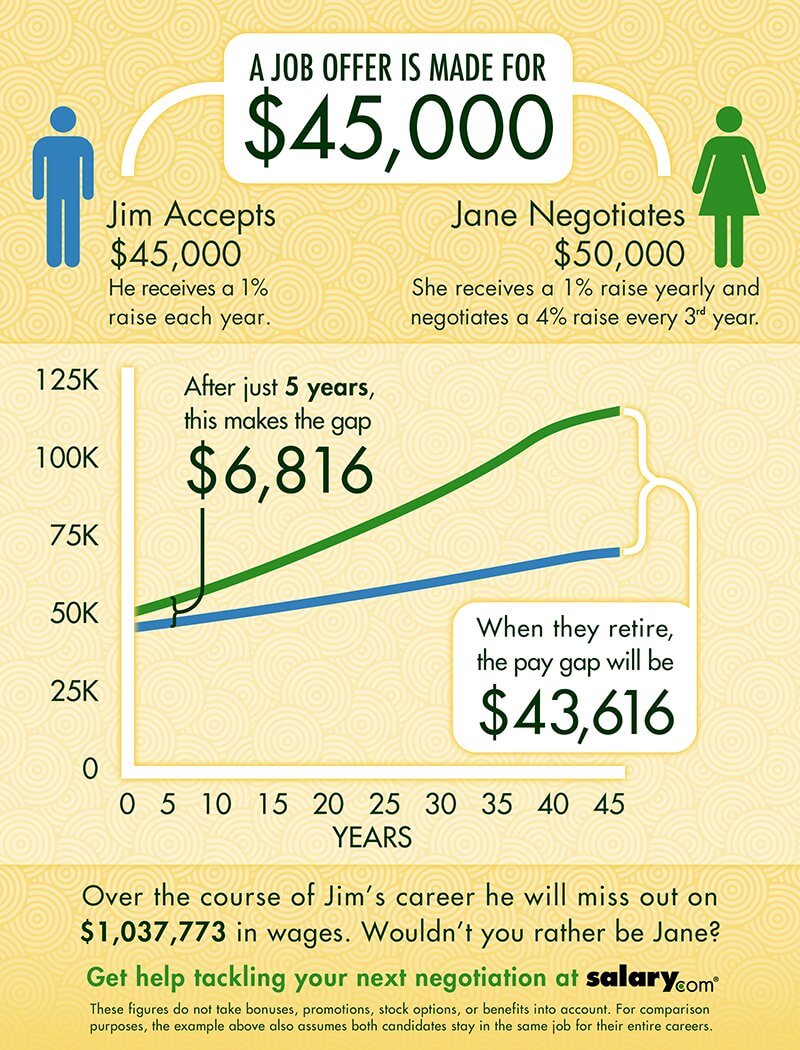

The worst case scenario is your company says no. But if they say yes, it’ll make your life easier. Here are some tips to help you ask for a raise and actually get it. And by keeping quiet, you may be screwing yourself. This graphic from Salary.com shows how much money you can lose by not negotiating your pay. Salary.com shows how much money you can lose by not negotiating a higher salary.

Make Benefits a Priority When Looking for a New Job

As young adults, we often look at salaries as the major deciding factor when accepting a job. However, if you want to be more financially savvy, also consider the benefits and perks the company is offering.

For instance, Cisco offers employees a gym with acupuncture and physical therapy. And Google’s benefits have been bragged about for years, including free food, the ability to bring your pets to work, free transportation and free gym access, amongst others.

With newer companies focusing on employee satisfaction, money-saving perks like these are starting to become more widely adopted.

Don’t Be Afraid to Switch Jobs

A list of personal finance tips that tells you to quit your job? Are you crazy?

I’m not telling you to just quit your job without a plan, but if you’re underpaid and struggling financially, it may be time to consider changing companies. This is especially true if you’ve made it clear to your manager that you don’t get paid enough and nothing is done.

Remember, you have to do what’s best for you, even if that means making a life change.

Hustle, Hustle, Hustle!

When you look at some of the most successful people in the world, they have something in common. They hustle.

Your twenties and thirties are prime times to focus on working hard and building a solid financial foundation. That could mean creating side hustles in addition to your full-time job, or even working multiple jobs if you want to. Just don’t get lazy.

Become an Affiliate for Products You Use All the Time

Speaking of side hustles, here’s a great idea that you may have never considered. If you’re always Tweeting about your favorite products or emailing links to your friends and coworkers, why not try to make a little money from it?

Many companies have affiliate programs where they will pay you a percentage of each online order for everyone you refer. A great place to get started is Amazon. They have one of the best affiliate programs available, and there’s a good chance you already shop there.

You can get started here.

Other

Learn to File Your Taxes Correctly (Or Hire Someone Who Knows How)

Have you seen those H&R Block commercials where they talk about how much money people miss out on when filing their taxes? Well it’s not just a sales pitch, it’s really true.

There are a lot of deductions most people aren’t aware of (not just young adults). If you’ve used online tools like Turbotax and Taxact to do your taxes, make sure you’re not missing out on any potential deductions.

As you start to earn more money and get more assets, doing taxes will become more complex. Especially if you have side hustles and multiple income sources. At that point, it might be worth talking with a tax preparation service or an accountant to make sure you’re maximizing your return.

Track Your Net Worth

Unless you created and sold a huge app, most millennials aren’t paying too much attention to their net worth. However, it can actually be very beneficial.

In its most basic form, your net worth is the difference between all of your assets (cash, investments, property, etc.) and your debt. If you use the Mint app, it has a tool that’ll calculate this for you.

Monitoring your net worth gives you an idea of whether or not you’re heading in the right direction financially. If you’re in the negative, don’t worry. A lot of young adults are. But you can use the personal finance tips here to help get you trending upwards.

Gamify Personal Finance

The reason I’m such a big fan of tools like Mint and Acorns is because they make personal finance fun.

For decades, young adults have avoided personal finance because it hasn’t been the most exciting thing in the world. Spreadsheets, math, RESPONSIBILITY!?!? Who wants to deal with that?

Thanks to apps, personal finance has become much more enticing and less intimidating. If you have a negative view of personal finance, try gamifying it with apps.

Learn About Money Management

Along the same lines as the previous tip, personal finance is a lot less intimidating when you spend some time learning the basics. Reading about money management on blogs like this or even through books and videos can be extremely helpful.

There is plenty of information out there, you just have to do some research to find it. The best part is the information is easily digestible and not dry and boring like a textbook.

Be Financially Independent

We’ve saved the best personal finance tip for last. Young adults, especially millennials, have a reputation of being entitled and lazy.

Taking control of your own finances means you’re able to stand on your own two feet without relying on a single source of income, your family or anyone else.